0xJeff (#Defi0xJeff) 2023-11-03

0xJeff (#Defi0xJeff) 2023-11-03

https://vxtwitter.com/i/status/1720501189903839568

#RWA #Staking #Lending #DEX #narrative #SocialFi #Derivatives #Yield #NFT #Stablecoin #Airdrop #Governance #Farming #AI #Oracle #DeFi #Eigenlayer #PERP #MC #SOL #bullish #UNI #Pendle #FRAX #GRAIL #ETH #BTC #ARB #ImgnAI #Tokenomics #APE #BASE #LiquidityProvider #GMX

𝐍𝐚𝐫𝐫𝐚𝐭𝐢𝐯𝐞 𝐑𝐨𝐮𝐧𝐝𝐔𝐩 #𝟏 — October Edition

Brief Look at Trending Narratives

Looking at Top Protocols Across

➔ RWA

➔ Arbitrum

➔ Solana

➔ AI

➔ Governance Blackhole

➔ LRTFi (Restaking)

➔ LPDFi

➔ SocialFi

➔ Intent

➔ GasFi (Gas Primitives)

Hop on In 👇

𝐏𝐫𝐢𝐦𝐞𝐫

This is going to be a new series that I'll be doing at the ending/beginning of each month as a way to stay on top of everything that's going on in the market

Hope this helps a lot of people who don't have the time to scour through CT for Narratives

0/60

𝐑𝐞𝐚𝐥 𝐖𝐨𝐫𝐥𝐝 𝐀𝐬𝐬𝐞𝐭𝐬 (𝐑𝐖𝐀𝐬)

This is one of, if not the most hyped up narrative during the past 1-2 months, especially during the deep bear market

Low Defi yields causing capital to migrate to TradFi's 5.5% yields on T-Bill at a relatively lower risk

1/60

Majority of the TVL is concentrated with MakerDAO in the form of $3.1bn diversified RWAs that are used to back DAI stablecoin & Dai Savings Rate 5

Main driver of the industry is still stablecoin that's backed by RWA yields (Short-term government bonds, Cashlike RWAs, etc)

2/60

Beyond Stablecoin, there are multiple RWA sectors such as (but not limited to)

• Credit / Lending

• Real Estate

• Yield Marketplace

• Startup Shares

• Luxury Items

I'll aim to highlight interesting projects with unique use cases across these sub-sectors

2/60

‣ Stablecoin

Offers STBT by working with @matrixdock (platform that connects accredited investors w/ RWAs)

⇢ STBT offers 5% yield generated from from U.S. Treasury securities and reverse repos. Interest is rebased to holders' balances everyday

3/60

TProtocol recently unveiled its v2, introducing RWA Lending and also USTP, TProtocol's Native Stablecoin that's backed by STBT

Key difference: STBT is Matrixdock's (offered to accredited investors) while USTP is composable in Defi onchain

$TPS IDO To be Announced Soon...

4/60

@fraxfinance

sFRAX

Frax v3 introduces sFRAX (Staked Frax) ERC-4626 that distributes part of the Frax Protocol yield weekly to stakers denominated in FRAX stables

6% APY is backed by newly minted FRAX stables 100% backed by Frax RWA strats. Each Epoch is 1-week long

5/60

The yields tracks IORB (Interest Rate on Reserve Balance) Rate which is practically US Risk-free Rate

Frax v3 utilize RWAs that yield very close to the IORB rate with as little duration risk as possible

Strats: ST T-Bill, overnight repo, USD, mutual funds

6/60

Suggests checking out @WinterSoldierxz thread on sFRAX for the deep dive for more information. There are bunch of good strategies you can do to earn pretty high yields on sFRAX

https://twitter.com/WinterSoldierxz/status/1712843861788119436

7/60

🧵: Frax Finance - Nothing Escapes The Singularity

As a child I was a huge fan of space and sci-fi

Black holes in particular, were the subject of my fascination

Galactic forces of nature feasting on every star and planet they touch

Providing the first regulated & transparent yield-bearing stablecoin

USDM Reserves are held under custody by JPMorgan & audited by OpenZeppelin

5% APY yields backed by T-Bill. You'd need to be KYC'ed to redeem USDM to fiat

8/60

‣ Yield Marketplace

Pendle needs no introduction. I love Pendle. I sacrifice my life for Pendle. Pendle in da bag... Pendle grape!

Jokes aside, probably one of the most versatile Defi project today with PMF that spans across several narratives like LST & RWA

9/60

Pendle has grown its TVL from $15m on January this year to $192m right now

% RWA TVL has grown to 15% ($29m) with sDAI being the main TVL driver

There are currently 3 RWA products from Pendle

• sDAI ~12% APY

• sFRAX ~15% APY

• fUSDC ~19% APY

Note: ^All Boosted APY

10/60

All of the yields from from the 3 RWA products are much higher than their original sources which are at ~5% APY

Pendle enables this by offering trading fees + Pendle incentives to the Pendle LP liquidity provider in exchange for creating a better yield trading environment

11/60

The $PENDLE token itself has seen +50% increase from the October low of $0.6 to $0.92

Almost 39m of PENDLE is locked as vePENDLE — that's 15% of the total supply and about 25% of the circulating supply

@Penpiexyz_io owns about 9m PENDLE while @Equilibriafi owns 7.6m

12/60

Given the increase adoption in yield-bearing assets, this is just the beginning of Pendle growth

We're seeing trends of LST, LRT (Liquid Restaking), and RWA

As long as people are farming & speculating on yields, Pendle will continue to grow in tandem

13/60

‣ Real Estate

Real Estate RWA promotes disintermediation, fractional ownership, enhanced liquidity (for owners), and accessibility of investors looking to diversify their portfolio

Regulation remains the biggest hurdle / risk that thwart the development of this sector

14/60

Would great thread that I see covering the key challenges of Real Estate and the general asset tokenization is from @lex_node

TL;DR -> Tokenizing RWA increases trust assumptions far above those even required for normal off chain ownership

Purported "tokenization" of purported "RWAs" is mostly fake/impossible--a brief thread

Perp DEX on Real Estate markets with up to 10x leverage — Parcl enables users to long or short real estate in different cities around the world

Parcl currently has 19 markets with 17 being US cities & 2 France cities. Parcl has $1m TVL & $20k OI

15/60

‣ Lending

During last year Maple Finance, the largest unsecured crypto lending platform almost imploded due to all the crashes especially Alameda Research's

Uncollateralized lending started shifting to SME lending, trade receivables, loans to fundamentally-sound biz

16/60

DeFi protocol that allows users to put excess stablecoin liquidity to work to fund RWA loans

Florence works with SME lenders to gain access to diverse SME credit exposure

Users can now earn 7 - 9.5% APY on these loans to SME biz on Florence vaults

17/60

‣ Startup Shares

Tokenized shares are not available in a lot of countries around the world BUT Switzerland has stepped up with its Swiss 2019 DLT Bill

This allows companies to digitized their shares & put them on the blockchain as its digital counterpart

18/60

Arcton enables marketplace for this, allowing users to participate in IPO directly on its platform

Users engaging in IPO would have to be KYC'd BUT when the share started trading on DEX, anybody can freely ape

First IPO, Money Masters starts on Nov 11

19/60

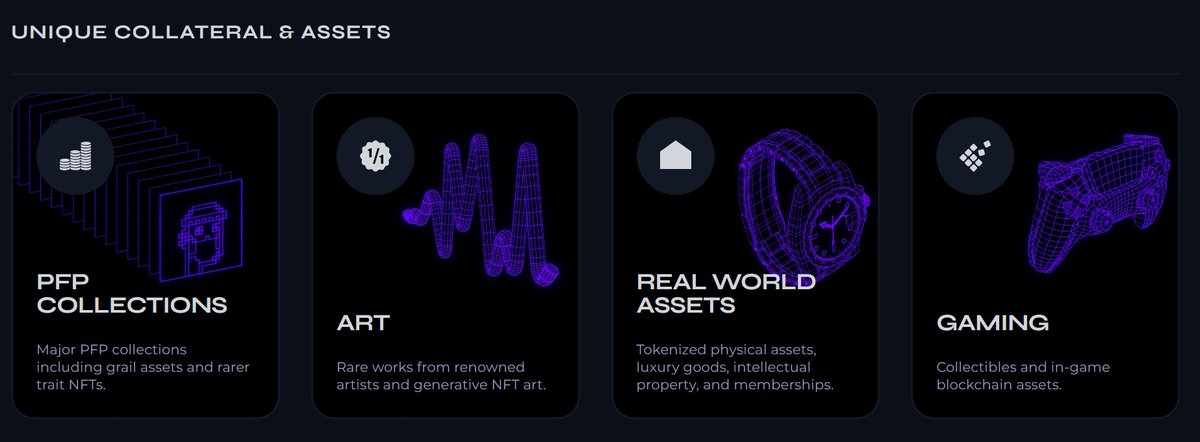

‣ Luxury / Collectibles

We're seeing very useful use cases in this category where luxury items like Rolex watches, sportscar, rare cards, and more can be tokenized

And then turned into an NFT to be used as collateral for P2P fixed borrowing APY loans

20/60

@Arcade_xyz

& 4K (Escrowed service)

Facilitates loans that use luxury watches as collateral, and employ NFTs to guarantee those loans’ terms

Borrowers send their watches to 4K & receive an NFT

If borrower doesn't pay back then the watch goes directly to lender

21/60

Galileo works with luxury brands to tokenize their assets & issuing proof of authenticity for their original & digital counterpart

It also provides tracking & 360-degree visibility into each asset's history and lifecycle from tokenisation onwards

22/60

𝐀𝐫𝐛𝐢𝐭𝐫𝐮𝐦

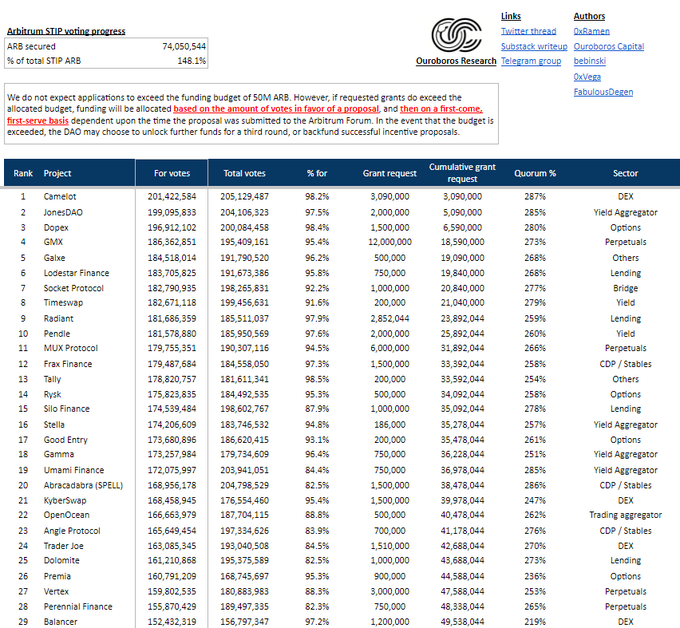

One of the most hyped narratives this season due to the recent Arbitrum Short-term Incentive Program (STIP) offering 50m $ARB to protocols building on Arbitrum

These rewards will be distributed during the next 3 months up until January 2024

23/60

Over ~30 protocols managed to get their grant approval approved with each protocol receiving differing amount based on their size, contribution, and plans

@0xRamenUmai have created a very good list for these projects: https://twitter.com/0xRamenUmai/status/1712670929569116398

24/60

1/ @arbitrum round 1 grant application has officially come to an end

Congratulations to the 29 projects which will collectively receive 49.6m ARB

Delegates came through in the last couple of hours, with all proposals achieving quorum

Since there are over ~30 projects receiving the incentives, I'll be highlighting only a few that are interesting

@GMX_IO ➨ highest amount of incentives (12m in ARB). Majority will be distributed as trading & liquidity incentives

This further solidifies GMX as #1 Perp

25/60

@LodestarFinance

➨ Arbitrum-native money market with best Grants/MC. Both TVL & Price of $LODE have been steadily increasing since early Oct

@JonesDAO_io ➨ OG vault project with second-best Grants/MC. Upcoming CL product + Tokenomics Revamp + Buybacks as catalysts

26/60

@CamelotDEX

➨ #1 Liquidity Hub on Arbitrum. Majority of the incentives will be used to incentivize many pools on Camelot

Enhancing liquidity for arb projects that list their LP on Camelot

This will lead to higher TVL ➙ higher Vol ➙ higher Rev = $GRAIL pumps

27/60

𝐒𝐨𝐥𝐚𝐧𝐚

Solana has seen growth in both its TVL & PA of $SOL. TVL grew 30% during the past 30 days, gaining $150m+ in value

$SOL 2x ($20 -> $40+) from beginning of Oct to right now

Driven by groups of KOLs & positive developments (Shopify) & Solana Breakpoint

28/60

TVL on Sol is mainly driven by liquid staking

@MarinadeFinance , @jito_sol , @LidoFinance are 3 most prominent liquid staking providers on Sol

Lido recently closed their liquid staked SOL so TVL has been flowing into Marinade & Jito

The play here is mainly on $SOL itself

29/60

𝐀𝐈

AI is resurfacing again due to the first OpenAI builder conference on Nov 6

Few projects are making a comeback with bullish announcements —

@imgn_ai x @nvidia

Imgnai got accepted to Nvidia's Inception Program, venture funding, industry-leading hardware, guidance

30/60

Mozaic made a comeback after a relatively slow post-LBP TGE during the deep bear market

$MOZ has seen 500%+ growth in the past 7 days off the back of AI narrative. Mozaic offers AI-powered vaults that actively search for best yield across chains

31/60

𝐆𝐨𝐯𝐞𝐫𝐧𝐚𝐧𝐜𝐞 𝐁𝐥𝐚𝐜𝐤𝐡𝐨𝐥𝐞

Refers to projects that accumulate governance tokens of other projects. There have been a few models / projects that came out e.g.

• Plutus for Arb Projects

• Single Project for Single Project (Equilibria for Pendle)

32/60

But the best model / project by far is @magpiexyz_io and its SubDAOs

Magpie itself accumulates the governance of @WombatExchange while continuing to roll out SubDAOs that accumulate new governance token of other fundamentally-sound projects

33/60

⇢ @Penpiexyz_io accumulating @pendle_fi vePENDLE

⇢ @Radpiexyz_io accumulating @RDNTCapital dLP

⇢ @Campiexyz_io accumulating @CamelotDEX xGRAIL

⇢ Soon Cakepie accumulating @PancakeSwap veCAKE

Same Magpie team supervises the development of new SubDAOs

34/60

The reason why it's set up like this is because the key challenge with accumulating governance token and issuing a derivative liquid token is maintaining the peg between the two

With every new SubDAO for a new project, they can raise capital for their new governance token

35/60

And utilize that capital to fund the development of new SubDAO as well as fund & incentivize the peg of the liquid token

For example, $PNP is used as reward to incentivize users to convert PENDLE to mPENDLE (Penpie's version of vePENDLE liquid token)

36/60

That result in high peg for its mPENDLE token (95% peg) while widening the gap in accumulating the vePENDLE vs its peer (Equilibria)

My thesis on Magpie here for those looking to learn more: https://twitter.com/Defi0xJeff/status/1679427610521264130

37/60

There has been multiple Mini Bull szn on Arbitrum 2023

⚔️ Camelot Launches (Q1)

⚙️ GMD Launches (Q2)

💼 Modular IWO Launches (Q2)

✨ Shiny New Coins (Q2 - Q3)

Here's Why I think ██████ Will Lead the Next Successful Launches on Arbitrum

And How to Position for it 👇

𝐑𝐞𝐬𝐭𝐚𝐤𝐢𝐧𝐠

The popularity of EigenLayer restaking has skyrocketed

EigenLayer enables a decentralized trust marketplace where other protocols can get access to trust

Users earn additional rewards -> ETH Yields + Restaking Yields + Projects Incentives (Emissions)

38/60

A few protocols have started to build on top of EigenLayer, offering liquid restaked token (LRT), allowing users to earn rewards without locking up their tokens (in a similar fashion to LST)

@restakefi , @AstridFinance , @KelpDAO (Stader's) are the top 3 LRT right now

39/60

Astrid was the first one to launch mainnet, got exploited for ~$230k, swiftly renumerated the loss back to victims, and successfully negotiated for 80% of the fund with the hacker

@ionprotocol is building a lending protocol for LST & restaking positions

40/60

@Etherfi

is the first project to build native restaking directly on Eigen Layer (Not live yet)

Liquid = Restake LST on Eigen's front-end (which is currently capped)

Native = Operate ETH Validator & Restake directly on Eigen Layer back-end = More Rewards than Liquid

41/60

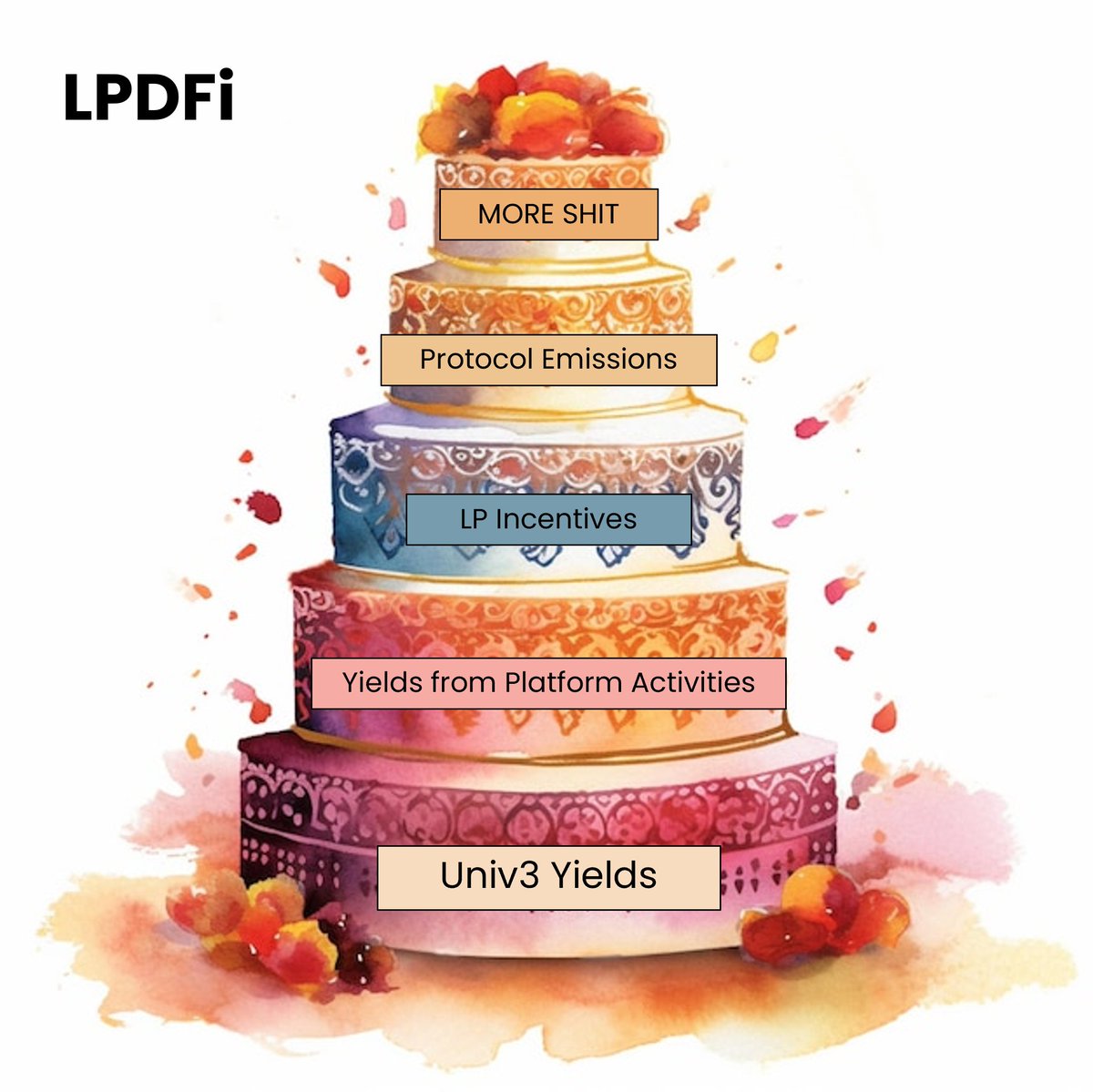

𝐋𝐏𝐃𝐅𝐢

Liquidity Providing Derivatives Finance refers to protocols that are building on top of Uniswap v3, rehypothecating that liquidity for something else (when not in use)

Perps, Options, Money Markets, and more, increasing capital efficiency & mitigating IL

42/60

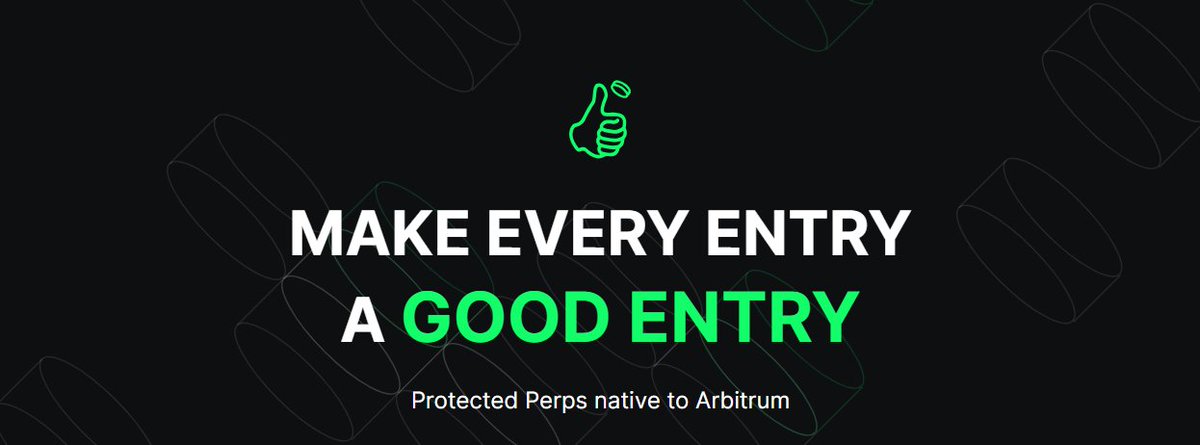

One of the projects that's launching their IDO soon is @goodentrylabs which offers Protected Perp

Allowing users to enter into perp positions without fear of getting liquidated due to sharp price movements. This is done through options

43/60

Traders purchase options on a block-by-block basis which rolls over until the traders close his positions

Traders pay funding rate to LP (ezVaults) which consists of trading fees, premiums, and borrowing fees

$GOOD TGE is coming on Nov 27 (FCFS) -> Make sure to be there!

44/60

@0xTindorr

Primer on LPDFi

https://twitter.com/0xTindorr/status/1705265145415598278

Note that in that list, you can get Impermanent Gain with Volatility Trading protocol like GammaSwap & Smilee BUT

You'll still experience IL on other LPDFi protocols but get additional APY from rehypothecated liquidity

45/60

LPDFi is making a big move. 🔥

There is a new protocol just launched on Arbitrum, and more are coming soon.

💎 LPDFi protocols will disrupt the way we provide liquidity in DeFi.

Curious about LPDFi?

↓ Let's explore EVERYTHING you need to get up to speed + project list

𝐒𝐨𝐜𝐢𝐚𝐥𝐅𝐢

Combination of Social Media + Defi, creating a creator economy that aligns the incentives of creators & the community

Friend Tech (FT) was born on Base and kickstarted the whole SocialFi narrative where people bet on each other's shares or keys

46/60

Creators earn 5% of the trading fees every time the keys are traded. Investors get access to private chatrooms with the creators

The model has shifted from private chatroom to decentralized social media

What FT & all SocialFi platforms have in common is the point system

47/60

Gamified airdrop system designed to acquire & retain users by incentivizing +EV actions on the platform

SocialFi hype has died down a bit due to the BTC & ETH pumps, when market was boring people had nothing to do except buy/sell keys & vibe w/ their community

48/60

Now since market is pumping, people sold their keys & shares and go back to shitcoining = SocialFi platform TVL down

@JavierAng_ has written a great post on FT Airdrop & its mechanics

https://twitter.com/JavierAng_/status/1706697010051739980

49/60

Not gonna lie... I thought FT was going to fall off after a month

I seriously UNDERESTIMATED the power of its airdrop program

Here's why I think FT's airdrop design will become the DE FACTO standard moving forward

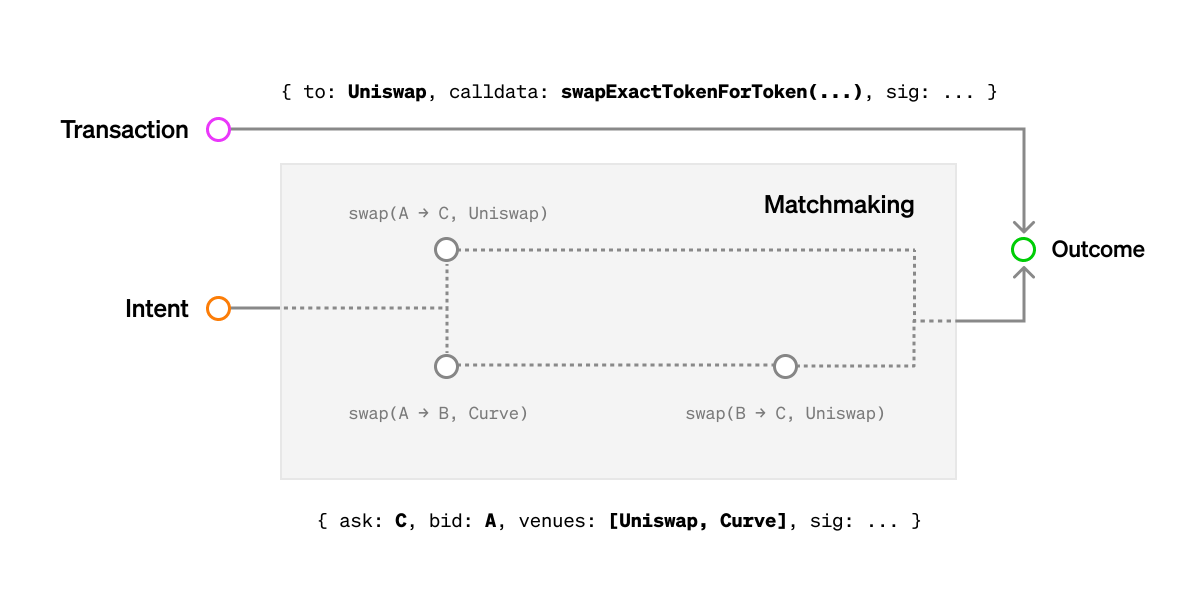

𝐈𝐧𝐭𝐞𝐧𝐭

Intent came into popularity because of @paradigm content piece on Intent-based architecture

Intent refers to the desired outcome you want

Intent ➔ "I want X, and I'm willing to Pay up to C"

Normal Txn ➔ "Swap A to B then Swap B to C"

50/60

By signing and sharing an intent, a user is effectively granting permission to recipients to choose a computational path on their behalf

The idea of "Intent" itself is not new as you may have seen "Aggregators" aggregating best price/yield for an action before

51/60

But the adoption of intent that spans to different use cases emerged with the goal to improve capital efficiency & improve UX

Account Abstraction — Gas Sponsorship, Transaction Batching with @argentHQ

Intent-based DEX (RFQ) @IntentX_ — Highest Efficency DEX, No Oracle

52/60

IntentX will be launching its Open Beta on Nov 15. I've covered a bit of the launch details & overview of IntentX on the posts below

Launch: https://twitter.com/Defi0xJeff/status/1717069702990868842

Overview: https://twitter.com/Defi0xJeff/status/1709084716371231172

53/60

Good Morning, GM Digest #74

Headlines

- From Uptober to Octover?

- UBS Pilot Tokenized Fund

- Smilee Trading Competition

- Introducing IntentX

- Good Entry TGE

- Contango cPerp

- TFI Listing

- Introducing Wandbot

- Zephyr IVO

- Pirex ETH Testnet

- Misc News

𝐆𝐚𝐬 𝐏𝐫𝐢𝐦𝐢𝐭𝐢𝐯𝐞𝐬

The ability for users, validators, NFT marketplaces, L2s, to hedge or speculate on Ethereum gas prices

There are 3 protocols that are stealthily building in this space, each with different approach to tackle the issue

54/60

Take the "interest rate swap" approach where it's an agreement between two parties — buyer & serller of hash power

Each party gets into bilateral commitments to exchange cash flows over a specified time frame. This is called Silica Contracts

55/60

Take the "CDP" approach where users deposit collateral and issuing BaseFee token that's pegged to logarithmic moving average of gas price (50 blocks)

BaseFee/ETH LP will be a passive strategy product that people can earn on (bet on range-bound gas prices)

56/60